Auction Strategy: When to Hold and When to Fold

Understanding Auction Dynamics: The Foundation of Strategy

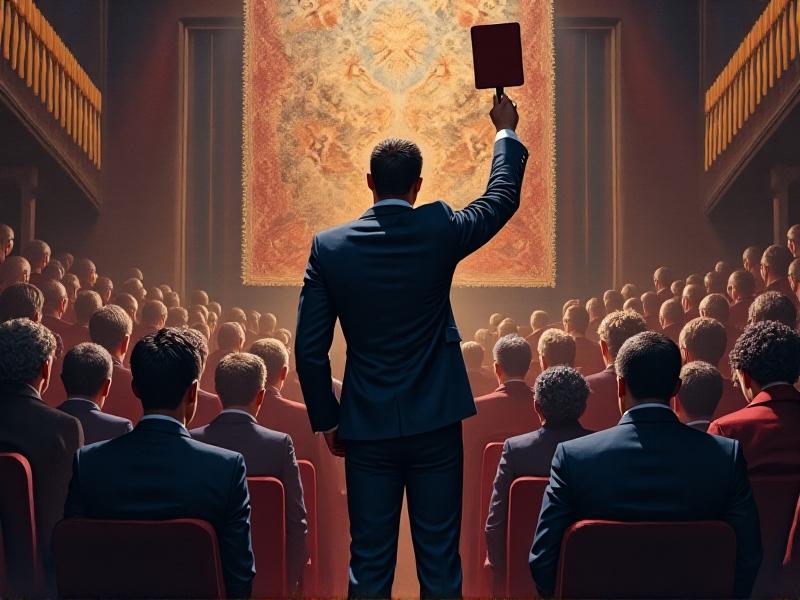

Auctions are battlegrounds of calculated risk, where split-second decisions determine victory or defeat. Whether you're bidding on rare art, real estate, or digital assets, success hinges on understanding the auction format and its inherent rhythms. English auctions (ascending bids) demand aggression, while Dutch auctions (descending prices) test patience. Sealed-bid auctions require psychological warfare—guessing competitors’ moves without visual cues. The key lies in aligning your strategy with the auction’s tempo. For example, in live auctions, adrenaline often overrides logic, creating opportunities for disciplined bidders to exploit hesitation. Meanwhile, online platforms introduce algorithmic sniping tools and time delays, altering the traditional playbook. Mastery begins with dissecting the rules, recognizing patterns, and adapting to the unique pressures each format imposes.

The Psychology of Bidding: Reading the Room

Auctions are as much about human behavior as they are about cold calculation. The thrill of competition can trigger irrational escalation, where bidders double down to “win” at any cost—even exceeding an item’s value. Skilled players watch for tells: rapid paddle raises, whispered consultations, or sudden hesitations. In online settings, bid frequency and timing replace body language. A bidder who jumps in immediately after a raise may signal confidence—or bluffing. Conversely, prolonged silences often precede strategic retreats. Emotional detachment is critical; anchoring to a predetermined budget prevents getting swept into ego-driven duels. Consider the “winner’s curse,” where the victor overpays due to incomplete information. By staying grounded in data and self-awareness, you transform psychological vulnerabilities into opportunities.

Strategic Holding: When to Push Your Advantage

Holding your ground requires a clear rationale. If you possess exclusive information—say, a rare coin’s provenance or a property’s development potential—aggressive bidding becomes justified. In ascending auctions, mid-game aggression can intimidate rivals, signaling unwavering resolve. Timing matters: early dominance establishes authority, while late surges exploit competitors’ fatigue. Art collectors, for instance, often bid assertively on emerging artists with rising trajectories, banking on long-term appreciation. However, holding isn’t endless; set incremental checkpoints. If the bid surpasses 70% of your max, reassess whether the asset’s ROI still justifies the risk. Remember, strategic holding isn’t stubbornness—it’s a calculated play to capitalize on undervalued opportunities.

Tactical Folding: Recognizing Exit Points

Folding is an art of disciplined restraint. Withdrawal isn’t failure—it’s resource preservation for future battles. Exit when bids exceed your pre-set limit, competition reveals overwhelming demand, or new information devalues the asset (e.g., a painting’s authenticity dispute). In real estate, folding might mean letting a rival overpay for a “hot” property in a cooling market. Online, use bid history tools to identify shill bidders or automated bots inflating prices. A graceful exit leaves rivals questioning whether they’ve won a prize or a liability. As poker pros say, “If you can’t spot the sucker at the table, it’s you.” Folding ensures you never become that sucker.

Leveraging Data and Auction Analytics

Modern auctions generate troves of data—bid histories, participant demographics, price curves—that reveal patterns. Tools like price-tracking algorithms identify undervalued assets, while sentiment analysis scans listing descriptions for hidden cues (e.g., “motivated seller”暗示ing flexibility). Historical benchmarks are invaluable: if similar NFTs sold for 2 ETH post-hype, bidding 3 ETH during a market slump is reckless. Real-time dashboards help spot anomalies, like a sudden bid surge from anonymous accounts. However, data is a guide, not a oracle. Pair analytics with intuition; a rare manuscript’s cultural significance might defy market trends. Balance spreadsheets with storytelling to outthink purely quantitative rivals.

Case Studies: Wins, Losses, and Lessons

In 2008, a bidder paid $68 million for a Mark Rothko painting, only to resell it in 2014 for $46 million—a cautionary tale about market timing. Conversely, a collector who bought a Basquiat for $19,000 in 1982 netted $110 million in 2017. The difference? Vision and patience. In tech, Google’s IPO used a Dutch auction to democratize access, rewarding bidders who ignored Wall Street’s inflated projections. Meanwhile, Beeple’s $69 million NFT sale relied on perfect storm of FOMO and cultural relevance. These cases underscore that context—economic climate, cultural trends, asset uniqueness—shapes outcomes. Learn from others’ triumphs and hubris.

Common Pitfalls: Avoiding Costly Missteps

Even seasoned bidders falter. Common errors include:

- Ego Bidding: Chasing “victory” despite ballooning costs.

- Anchoring Bias: Overvaluing initial price estimates.

- Herding: Mimicking others’ bids without independent analysis.

- Ignoring Fees: Forgetting buyer’s premiums or taxes that inflate final costs.

In 2015, a buyer paid $4.6 million for a Ferrari 250 GTO, only to discover $700k in hidden fees. Mitigate risks by rehearsing bids in mock auctions, consulting experts, and stress-testing budgets against worst-case scenarios.

Future Trends: AI, Blockchain, and Beyond

Auctions are evolving. AI-driven platforms now predict optimal bid ranges using machine learning, while blockchain enables transparent, tamper-proof sales. Decentralized auctions on Ethereum let participants bid globally without intermediaries. Meanwhile, VR auctions immerse bidders in 3D galleries, inspecting virtual real estate or digital art. However, tech introduces new risks—deepfake forgeries, algorithmic collusion. Staying ahead means embracing tools without losing the human edge: creativity, adaptability, and ethical discernment. The future belongs to hybrids: part analyst, part strategist, part philosopher.